In recent years, Saudi Arabia has made significant strides toward digital transformation, particularly in its financial and tax systems. One of the key initiatives introduced by the Zakat, Tax and Customs Authority (ZATCA) is the implementation of electronic invoicing (e-invoicing) regulations for Billing Software in Saudi Arabia. These regulations aim to streamline tax compliance, enhance transparency, and reduce fraud. The e-invoicing regulations are rolled out in two distinct phases: the Generation Phase and the Integration Phase.

Phase 1: The Generation Phase

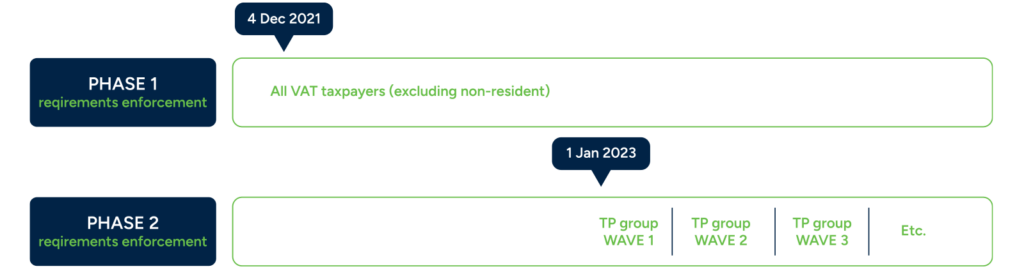

In December 2020, ZATCA announced the first phase of the e-invoicing initiative, known as the Generation Phase. This phase mandated that all businesses in Saudi Arabia must issue and receive electronic invoices by December 2021.

Key points of this phase include:

- Transition from Manual to Electronic Invoicing: From December 2021 onwards, businesses can no longer use manual invoices. Instead, they are required to adopt a compatible e-invoicing system that can generate, send, and receive electronic invoices

- Storage and Archiving: The e-invoicing systems must also include features that allow for the secure storage and archiving of all issued invoices. This is crucial for compliance and auditing purposes, as ZATCA can access these records to ensure adherence to tax regulations.

This initial phase set the groundwork for a comprehensive digital invoicing system in Saudi Arabia, pushing businesses toward modernization and enhancing the overall efficiency of financial transactions.

Phase 2: The Integration Phase

Building on the success of Phase 1, ZATCA launched the Integration Phase on January 1, 2023. This phase introduces more stringent requirements, primarily focusing on integrating e-invoicing systems with ZATCA’s platform, known as FATOORA.

Key aspects of the Integration Phase include:

- API Integration: Businesses are required to integrate their e-invoicing systems with ZATCA’s API, allowing for real-time data sharing and improved oversight. This integration helps ZATCA monitor transactions more effectively and ensures compliance with tax regulations.

- Staggered Implementation: The Integration Phase rolled out in waves based on a company’s taxable turnover for 2021 or 2022. Businesses with higher turnover face earlier compliance deadlines.

Upcoming Waves of Obligation

The Integration Phase is divided into several waves, each targeting businesses with specific revenue thresholds. Here’s the schedule for upcoming waves:

Beginning in October 2024, companies will enter phased compliance integration based on specific revenue thresholds. This scheduled rollout targets businesses progressively each month, concluding in April 2025. Ensure your business is ready and aligned with each compliance wave.

Implications for Businesses

The implementation of these phases presents both challenges and opportunities for businesses operating in Saudi Arabia:

- Compliance Costs: Businesses may incur costs related to upgrading their systems to meet e-invoicing requirements and integrating with ZATCA’s platform.

- Enhanced Efficiency: On the flip side, e-invoicing can lead to improved operational efficiency. Automated invoicing processes reduce manual errors, speed up transaction processing, and enhance cash flow management.

- Increased Transparency: With real-time data sharing, businesses can benefit from increased transparency in their financial operations, which can improve relationships with tax authorities.

- Competitive Advantage: Companies that adapt early to these regulations may gain a competitive edge, positioning themselves as forward-thinking and compliant entities in the marketplace.

Conclusion

The best online e-invoicing software in Saudi Arabia‘s regulations marks a significant shift toward a more digital and efficient tax system. As businesses prepare for the upcoming waves of the Integration Phase, it is crucial to assess their current invoicing systems and make the necessary adjustments to ensure compliance. By embracing this change, companies can streamline their operations, enhance compliance, and position themselves for success in an increasingly digital economy.

Thanks for reading!

Please feel free to share your thoughts and opinions in the comments section. If you want learn more about our latest version please visit our website or call us at +966 55 506 5473.

If you’re ready to take your billing process to the next level with Bridge Bills, try a 14-day free trial now.

That’s All. For more information mail us at info@bridgebills.com.Follow us on Twitter, LinkedIn, Instagram, and Facebook

Bridge Bills Video Tutorial